The state of the economy, particularly unemployment and racially-based income inequality, is normally reliable political fodder but the weaker exchange rate has given further ammunition to opposition parties.

The argument has narrowed from opposing the broad suite of economic policy as either being too market friendly or interventionist (depending on the political party) to arguing that the person of the President himself is detrimental to economic growt.

This trend is set to intensify as the 2016 Municipal elections draw near, especially since the Independent Electoral Commission (IEC) admitted it will be the most heavily contested election in South Africa’s post 1994 democracy. However, the political attacks against the president based on the weaker exchange rate are largely misguided and detract from a more accurate debate as to the root cause of our economic challenges.

The exchange rate holds a near-mythical quality for most South Africans as the wise judge of our folly. Many older South Africans would bitterly compare the so called “glory days” when the rand was stronger than the American dollar; the implication being that the weaker exchange rate is self-evidence of poor policy and governance.

To untangle that view would require far more space and patience than this insight, but suffice it to say that the exchange rate is still seen as the final arbiter, by its own people, on whether this current iteration of our democratic South Africa is working or not. While there is an element of truth to this hypothesis, as a whole it is far too simplistic - and for many, far too convenient too.

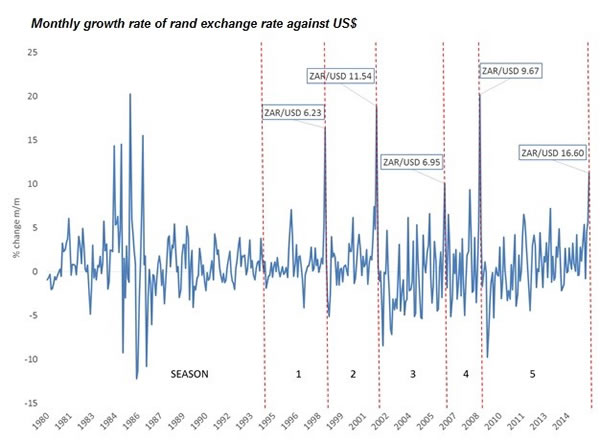

The five "seasons" of the rand exchange rate

Even assuming that the exchange rate is indeed the most notable judge of economic policy and governance, the case against President Zuma is flawed. The criticism of his administration based on the exchange rate alone is patently wrong, since the exchange rate has been more stable and depreciated less during his term of office than compared to his predecessor, Thabo Mbeki. Even more “controversially”; the rand depreciated less on average during Zuma’s term than Mandela’s, when South Africa undoubtedly had the support of the whole world - even cold-hearted investors.

Post 1994, South Africa has had five exchange rate seasons based on the growth rates between monthly averages, with each season ending whenever the monthly growth went beyond 10%. While the rand did recover from R11.54 to the dollar in December 2001 to spike at R6.95 in June 2006, the period was hardly tranquil and had a standard deviation (a measure of volatility) of 3.5 for monthly growth, compared to the standard deviation of 2.9 in the period October 2008 to January 2016.

More importantly, the average monthly depreciation for the last season was 0.55%, compared to 1.14% in the period July 1998 to December 2001.

These seasonal end-points overlap with real-world events like the East Asian crisis in the late ‘90s and the global credit crunch in 2008, which indicates that global events whose impact reached far larger economies than South Africa, also had their way with the exchange rate.

It's the (world) economy

The world economy arguably has a far bigger impact on the rand exchange rate than anything the South African government can possibly do, besides of course consciously sabotaging the currency. A big focus in the coming weeks is on the potential credit ratings downgrade which the National Treasury will do its best to avert by ensuring that the fiscal path remains sustainable. In turn, this will require that the deficit be managed so the ultimate debt/GDP ratio remains within a range comfortable to sovereign bond investors.

It should be remembered that President Zuma’s political decisions decide high-level issues such as who will be the Minister of Finance and which spending items need priority. However, the channel is President, then Minister of Finance, then National Budget, then Agency analysis and rating, then rand exchange response, which is a far cry from the popular view: Zuma, then exchange rate.

Democracy demands accountability, even from the president. But accountability wrongly assigned does more to muddy the analysis and let those who should be accountable get away from public scrutiny. It may seem like splitting hairs - and it is far easier to blame the man in charge - but that ignores the malign impact of several broad economic policies that are playing out in the real world, many of which have been inherited by the current president.

The right question to ask then is “why didn’t the President change those misguided policies?”

The South African representative of one of the credit rating agencies recently said that they look towards clear policy action on issues such as labour market regulation, which is not directly linked to the fast moving world of international capital markets.It must also be acknowledged that the best of domestic economic policies can only do so much against the onslaught of global trends.

The reality is that the weakening in commodities, due to China’s soft landing over the past year or so, has had a far greater impact on the long-term exchange rate than any government mishap. South Africa is no exception, most emerging market currencies took a beating as fund managers reverted to the conventional safe haven investing.

Given the sharp decline in the combined gold and platinum price, it is actually quite impressive that our currency did not depreciate much worse than it has in the most recent currency season (see graph below).

Swing loooooooow

A second implication of currency-as-governance-measure is that government must focus its energy to ensure that the exchange rate either strengthens or at least does not weaken from its current position. However, here’s the bad news; the rand will likely continue to depreciate. The good news is that it doesn’t matter as much as many may think.

If an exchange rate was an absolute measure, for example, of how much air one needs to survive in an insulated room, then that argument would hold. But stating as a concern that the rand can reach R20 to the US dollar is much like reminiscing over the time you could buy a piece of Chappies bubble-gum for 5c.

While it would certainly be fantastic if you could still buy Chappies for 5c each in terms of the income you earn at the moment, you should remember that if you only earned R100 a month ‘back in the day’, then 5c is a pretty steep price to pay for that Chappies. Similarly, the nominal exchange rate is not the be-all and end-all, it is simply a way to transfer economic shocks.

The problem is not the level of the exchange rate, but rather how difficult it is within the current regulatory environment for the private sector to adapt to those changes. Don't be distracted by the currency, the discussion about the actual policies that rule our lives is the one we need to be having.

Source: Instinctif Partners