Home buyers benefit from higher home loan approval rates and more affordable property prices

Despite weak economic fundamentals resulting in negative real house price growth, the banking industry continues to show confidence in South Africa’s property market by further relaxing their lending criteria and approving home loan finance at levels last seen 12 years ago.

FNB Residential Property Barometer for September Summary

Jump-start needed for economy, says Dr Andrew Golding

Sentiment is a key driver of investor confidence and the residential property market is no different in this regard.

Cape Town's resilient property market on the move again

The surge in first-time buyers entering Cape Town’s property market – a notable 3.3 times more than this time last year – augurs well for a gradual house price recovery in the next few months, says Dr Andrew Golding, chief executive of the Pam Golding Property group.

Marginal uptick in household credit and mortgage balances growth

Growth in the value of outstanding credit balances in the South African household sector (R1 669,6 billion) was only slightly higher at 6,1% year-on-year (y/y) at the end of May 2019 from 6% y/y at end-April when outstanding balances came to R1 660,9 billion.

Continued stable growth in household credit and mortgage balances

Growth in the value of outstanding credit balances in the South African household sector (R1 660,9 billion) remained relatively stable in the first four months of 2019, recorded at 6% year-on-year (y/y) at the end of April this year.

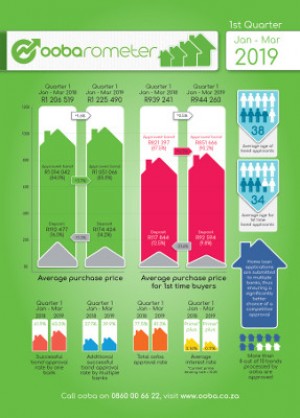

Bonanza for property buyers as home loan approval rates reach levels last seen 12 years ago

Buying a new home continues to become more affordable as weakening housing demand results in ongoing negative real price growth (after inflation) in the residential property market.

Stable repo rate underpins ongoing resilience of residential property market, says Dr Andrew Golding

With inflation currently below the mid-point of the Reserve Bank’s inflation target and economic growth remaining sluggish, the Monetary Policy Committee kept the repo rate steady at 6.75%, as expected.

Rising Absa Homeowner Sentiment Index in Q4 2018

Residential property market sentiment in South Africa increased over a wide front in the final quarter of 2018 on the back of an improved economic performance.

Growth in household credit balances accelerated in 2018 from 2017

The value of outstanding credit balances in the South African household sector increased by 5,7% to R1 630,2 billion in 2018 after rising by 3,8% in 2017.

eProperty News is a leading online commercial property marketplace serving the Southern African Investment, Office, Retail and Industrial property and allied sectors.