According to the National Treasury’s 2019 Budget Review report, the adjustments will lead to an excise burden slightly above the targeted levels.

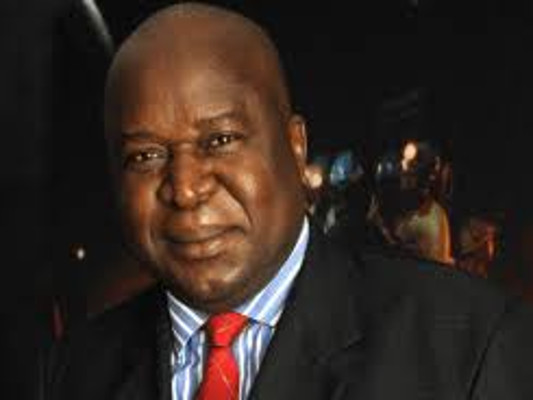

Delivering his budget, Mboweni said with a 12 cents increase, there will now be a R1.74 excise duty increase on a can of beer.

Other increases include:

- A 750ml bottle of wine will have an excise duty of R3.15, which is 22 cents more;

- The duty on a 750ml bottle of sparkling wine goes up by 84 cents to R10.16;

- The duty on a bottle of whiskey will go up by R4.54 to R65.84;

- A pack of 20 cigarettes goes up by R1.14 cents to R16.66; and

- The excise duty on a typical cigar will go up by about 64 cents to R7.80.

There will be no change to the excise duty on sorghum beer, the Minister said.

The 2019 Budget Review report said excise duties on alcoholic beverages are determined based on a percentage of the weighted average of their retail price.

“The targeted excise tax burden for wine, beer and spirits is 11 percent, 23 percent and 36 percent respectively. Since 2002, tax rates on these beverages have increased above inflation each year, alongside above-inflation retail price increases, to maintain taxes at the targeted level. Government proposes to increase excise duties on alcoholic beverages by between 7.4 percent and 9 percent in 2019/20,” the report stated.

The adjustments, added the report, will lead to an excise burden slightly above the targeted levels.

“The targeted excise tax for tobacco products is 40 percent of the retail selling price of the most popular brand within each product category,” the report said.

“Government proposes to increase the excise duties on tobacco products by between 7.4 percent and 9 percent. Cigarette makers appear to have absorbed most of the increases last year rather than increasing prices. As a result, the excise burden for cigarettes is likely to remain slightly above the target level.”

Levies

Mboweni in his speech announced that fuel levies will increase by 29 cents per litre for petrol and 30 cents per litre for diesel.

South Africa has three main fuel taxes that apply to petrol, diesel and biodiesel: the general fuel levy, the customs and excise levy and the RAF levy. From 5 June 2019, a carbon tax of 9c/litre on petrol and 10c/litre on diesel will become effective.

“These levies fund general government expenditure, support environmental goals and finance the RAF.

Diesel refunds cannot be claimed against this tax. The general fuel levy will be increased by 15c/litre for petrol and diesel from 3 April 2019. The increase is slightly below inflation. Government also proposes to increase the RAF levy by 5c/litre from 3 April 2019,” the 2019 Budget Review reports reads.

“The Road Accident Fund levy increase is not enough to match the Fund’s R215 billion liability. We urge the Department of Transport to quickly resubmit the Road Accident Benefit Scheme Bill for Parliament’s urgent consideration. It will help stabilise fuel prices,” Mboweni said.

He added that the National Treasury will work with the Department of Trade and Industry and the Department of Economic Development to explore the introduction of an export tax on scrap metal.