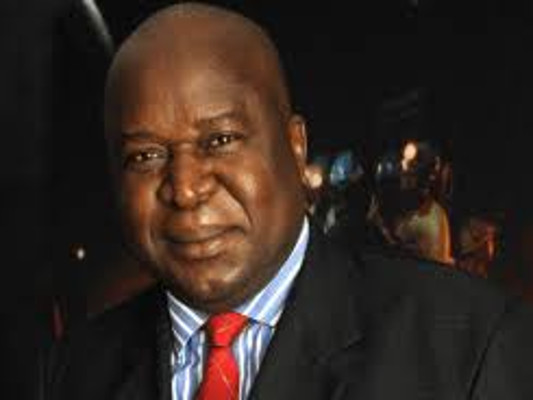

Mboweni said this when he tabled his maiden Budget Speech in the National Assembly on Wednesday.

When he delivered the Medium Term Budget Policy Statement in October, Mboweni said the country was “at a cross-roads”, with revenue collection projected at R1.3 trillion against a spending of R1.5 trillion, which meant at the time that government would spend R215 billion more than it had.

“First, we must look at the President’s task list. Then we must match the resources we have to the plan. In this current year, tax revenue has been revised down by R15.4 billion compared to our October estimate.

“Approximately half of the increase in the shortfall since October is due to higher than expected VAT refunds.

“This lowers revenue collection for the year, but puts money back into the economy,” he said.

SARS is being fixed

Despite the shortfall, Mboweni said the challenges at SARS are being addressed.

“SARS is being fixed. My thanks goes to Judge Nugent and his panel for their wise counsel,” he said.

Judge Nugent and his panel recently made their recommendations for SARS, public.

In response to this, Mboweni said a new Commissioner will be appointed in the coming weeks.

The new Illicit Economy Unit, launched in August 2018, will fight the trade in illicit cigarettes and tobacco. The large business unit is a major source of tax collection. This unit will be reintroduced and will be formally launched in early April 2019.

SARS is strengthening its IT team and its IT systems, and this is crucial for tax collection efforts. Information sharing agreements with allies will help fight cross-border tax evasion schemes, said Mboweni.

The tax gap, which is the difference between revenue collected and what ought to be collected, will also be assessed. There will also be a review of the proliferation of duty free shops inside South Africa.

“Fiscal prudence requires some tax changes. We propose additional revenue measures of R15 billion in 2019/20. There will be a slight upward adjustment of the tax-free threshold for personal income taxes, with no change in the current personal income tax brackets. Together these will raise R12.8 billion,” Mboweni said