“Government is stepping up its infrastructure build programme by partnering with the private sector, development finance institutions and multilateral development banks to create an infrastructure fund,” said the 2019 Budget Review document.

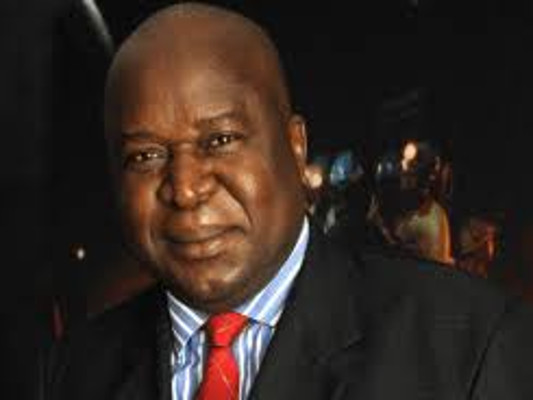

This as Finance Minister Tito Mboweni tabled his maiden Budget in Parliament on Wednesday.

“Government intends to commit at least R100 billion to the fund over the coming decade to leverage private-sector and development finance funding for well-planned capital projects. The support will take different forms, including blended co-funding, capital subsidies, and long-term interest rate subsidies and guarantees,” noted the document.

The document highlighted that the fund will increase the number of blended-finance projects to enhance oversight, improve the speed and quality of spending, and reduce costs in public infrastructure.

“The fund will draw on global expertise to strengthen project preparation and implementation,” said the document.

Over the past two decades, South Africa’s public infrastructure investments have amounted to about R3 trillion. However the speed, quality and efficiency of many of these projects, however, has not matched the level of investment, due to project planning at all levels, including for long-term maintenance, proving to be inadequate.

The review noted that discussions are underway with the Development Bank of Southern Africa (DBSA), the World Bank and the New Development Bank.

Over the next three years, general government infrastructure investment plans will amount to R526 billion.

“Work is underway to support some existing projects and programmes with blended finance. Government will seek out private-sector skills in the design, construction and operation of key projects.”

As a first step, the DBSA, in partnership with the National Treasury, will step up infrastructure lending. Blended-finance projects ready for implementation – including student housing projects – will be expanded, with R1 billion added in 2019/20 for this purpose.

A further R4 billion will be added in the outer year of the fiscal framework for projects that have complied with the requirements of the Budget Facility for Infrastructure.

Review of legislation

Meanwhile, National Treasury will review existing legislation to determine how existing processes may be able to incorporate blended-finance.

At the tabling of the Medium Term Budget Policy Statement (MTBPS) in October, Treasury announced that the specifics of the fund that was announced as part of South Africa’s stimulus package, would be fleshed out in this year’s budget.

At the time, the MTBPS stated that work to design the fund was underway, with assistance from the private sector and multilateral development banks.

The 2019 Budget Review highlighted that the DBSA’s experience with independent power producers suggests that the blended-finance approach can be applied in wastewater treatment, broadband connectivity and public transport.

“The National Treasury will review existing legislation to determine how existing processes may be able to incorporate blended-finance arrangements. The National Treasury has begun the process of drafting legislation to support the fund,” it said.